Close

Imagine a world where insurance processing is not just robotic monotony, but a vibrant and dynamic social ecosystem. A realm where policies, claims, and coverage decisions are not confined to sterile offices, but rather flowing through a flourishing network of meaningful interactions and shared knowledge. Is it possible for the traditionally staid and bureaucratic insurance industry to embrace a more social approach? Can insurance processing truly become more social, connecting people in ways that enhance their experiences, foster trust, and simplify the complexities of navigating the realm of coverage? Welcome to the exploration of this intriguing question, where we delve into the potential for an industry often associated with red tape to inject a dose of social synergy into its veins. Brace yourself for an exhilarating journey into the realm of possibilities as we uncover whether the worlds of insurance and socialization can converge, transforming the landscape of risk management as we know it.

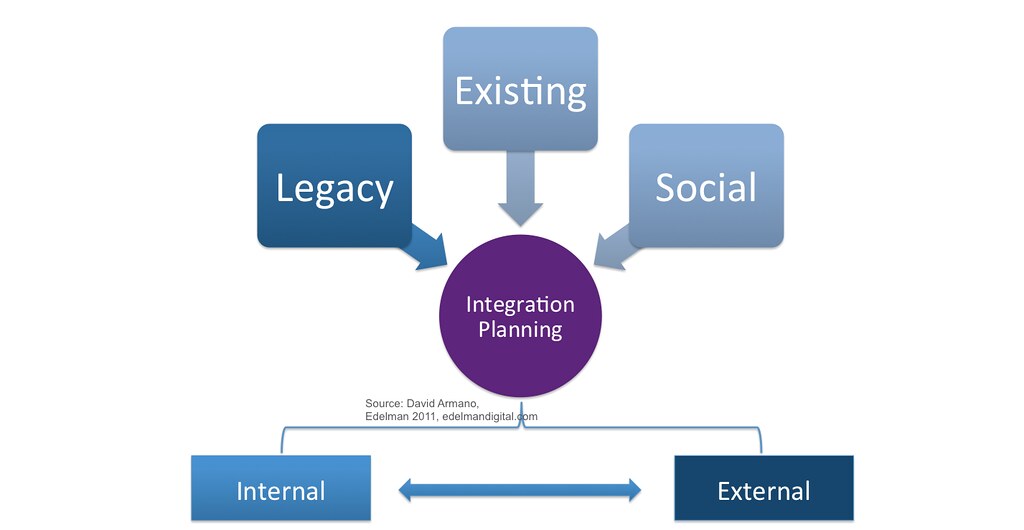

Insurance has always been perceived as an individualistic process, with policyholders solely responsible for their own coverage and claims. However, as society evolves and technology progresses, there is an emerging shift towards a more collaborative approach in insurance processing. Socializing insurance brings together individuals, insurance companies, and technological advancements to create a more interconnected and efficient system.

Collaborative processing in insurance takes advantage of the power of collective intelligence. Instead of relying solely on insurance agents and adjusters to assess risks and process claims, socializing insurance involves leveraging the knowledge and experiences of a wider network. By tapping into the wisdom of the crowd, policyholders can benefit from a diverse pool of information and insights. Collaborative processing also allows for faster and more accurate risk assessment, as data can be collected and analyzed collectively to identify patterns and trends.

In today’s rapidly evolving insurance landscape, social integration is proving to be a game-changer. By harnessing the power of social media platforms, insurers can seamlessly connect with their customers, improve service delivery, and drive business growth. One of the key advantages of social integration in insurance practices is enhanced customer engagement. Through interactive posts, insurers can initiate conversations, gather feedback, and gain valuable insights into customer preferences and needs. This direct line of communication not only fosters transparency but also builds trust, as clients feel acknowledged and valued on a more personal level.

Another significant benefit of social integration is the ability to streamline insurance processes, delivering a hassle-free experience to policyholders. By incorporating user-friendly online portals, customers can conveniently submit claims, access policy information, and even obtain instant quotes. This digitization not only saves time for both insurers and clients but also reduces paper waste, contributing to a greener environment. Furthermore, social integration allows insurers to leverage customer data to customize their offerings, tailoring insurance packages to individual needs and preferences. Such personalized solutions not only increase customer satisfaction but also enhance overall retention rates, leading to long-term business success.

In today’s interconnected world, leveraging social insurance processing has become a powerful tool for businesses aiming to enhance their efficiency and empower their customers. By streamlining the processing of insurance claims, companies can drastically reduce administrative costs while also providing a seamless and convenient experience to policyholders.

One of the key benefits of social insurance processing is the automation of tasks that were traditionally time-consuming and error-prone. By adopting advanced technologies, such as artificial intelligence and machine learning algorithms, insurance companies can expedite the assessment of claims, ensuring faster payout times and minimizing the possibility of fraudulent activities. Moreover, the integration of electronic systems with online portals or mobile applications allows policyholders to submit and track claims effortlessly, eliminating the need for manual paperwork and lengthy waiting periods.

Here are some ways social insurance processing enhances efficiency and empowers customers:

By embracing the potential of social insurance processing, companies can revolutionize their operations, making insurance transactions more efficient, transparent, and customer-centric. Through this digital transformation, both businesses and their policyholders can reap the benefits of a simplified and accessible insurance ecosystem.

In an era where social interactions dominate our everyday lives, it’s time for insurance processing to take a leap into the world of social experiences. By incorporating social elements into insurance workflows, providers can not only streamline their processes but also enhance customer engagement and satisfaction. Here are some innovative recommendations to transform insurance processing into a truly social experience:

Why limit communication to traditional channels when you can leverage the popularity of social media? Enable customers to connect with insurance professionals and share their experiences through seamless integration with platforms like Facebook and Twitter. This way, policyholders can reach out for clarification, receive prompt responses, and comfortably share feedback or testimonials with their social network.

Bring insurance processing to life by fostering online communities where policyholders can connect, learn from each other, and feel a sense of belonging. Create dedicated forums or discussion boards where customers can exchange tips, advice, and share stories related to insurance. This not only builds trust and loyalty but also provides a valuable platform for peer-to-peer support and knowledge sharing.

As we conclude this exploration into the realm of insurance processing, one question lingers in our minds: can it truly become more social? In our journey, we have skimmed the surface of the potential benefits and challenges that lie ahead in transforming this industry. While the insurance world may not have initially seemed like the most inviting space for social interaction, the ever-evolving landscape of technology and customer expectations makes this question imperative to consider.

With social media taking center stage in various aspects of our lives, embracing its power in insurance processing seems only logical. The potential for seamless communication between insurers and policyholders, the ability to address concerns and queries promptly, and the opportunity to build trust and understanding are all within arm’s reach. Opening up the channels of communication beyond mere phone calls or emails, insurance providers can utilize social platforms as tools to forge meaningful connections with their customers.

However, just as with any technological advancement, there are hurdles to overcome. Privacy and security concerns loom large, and it is essential to strike a delicate balance between convenience and safeguarding sensitive information. Regulatory frameworks and compliance measures must be carefully crafted to ensure that the increased social aspect of insurance processing does not compromise the integrity of the industry.

Nonetheless, the potential benefits that spring forth from embracing a more social approach to insurance processing are undeniably enticing. It calls for innovation, collaboration, and a keen understanding of the changing dynamics between customers and insurers. By harnessing the power of social platforms, insurers can create a community-like atmosphere that fosters trust, accessibility, and transparency, ultimately paving the way for a more harmonious insurance landscape.

As we step into the future, one thing remains clear: the insurance industry cannot afford to ignore the winds of change blowing in from the realm of social media. By delving deeper into the possibilities of interconnectedness, insurers have the opportunity to reimagine the entire insurance journey. From policy acquisition to claim handling, transforming insurance processing into a more social experience may just be the catalyst that revolutionizes the industry.

In this quest for social modernization, the road may be winding, but the potential rewards are numerous. So, let us dare to imagine an insurance world where policyholders feel heard, supported, and valued, and where insurers can embrace the transformative power of social connections. Together, we can unlock a future where insurance processing is not just a transactional necessity, but a genuinely human experience that safeguards our lives and dreams. As the curtain falls on this discourse, let us embark on this journey, hand in hand, towards a more social

future of insurance processing.